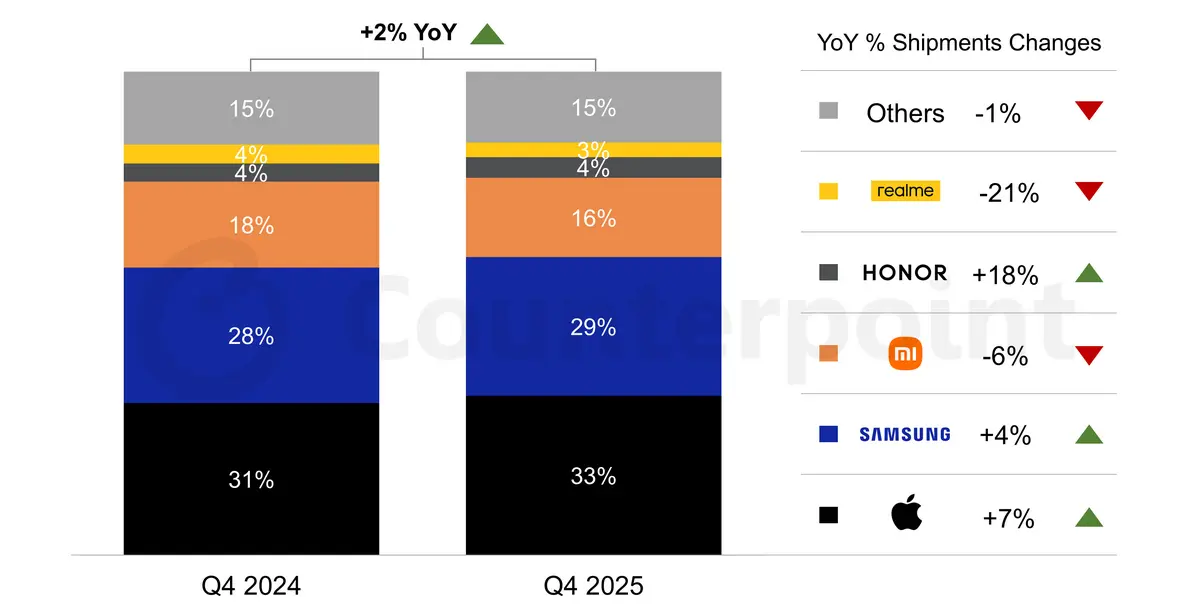

The European smartphone market wrapped up 2025 with modest gains as shipments increased by 2% during the final quarter compared to the same period in 2024. According to Counterpoint Research's latest market monitor, the region saw steady demand despite ongoing economic pressures affecting consumer spending across multiple countries.

Apple dominated the European market with an estimated 33% share of all shipments during Q4 2025. The Cupertino-based company benefited from strong demand for its iPhone 17 series, which helped drive a 7% year-over-year increase in shipments. Eastern Europe proved particularly receptive to Apple's latest flagship lineup, contributing significantly to the brand's regional performance.

Samsung and Xiaomi Round Out Top Three

Samsung secured second place with a 29% market share and recorded a 4% rise in shipments compared to Q4 2024. The South Korean manufacturer maintained its position through a balanced portfolio spanning budget-friendly Galaxy A series devices to premium foldable smartphones.

Xiaomi claimed third position with approximately 16% of the European market, though the Chinese brand experienced a 6% decline in shipments during the quarter. The drop followed weaker-than-expected demand for the Xiaomi 15T series, which failed to generate the sales momentum seen with previous generations.

Honor demonstrated impressive growth momentum, capturing an estimated 4% market share while achieving an 18% increase in shipments. The brand's expansion across Western Europe drove this performance, signaling renewed competitiveness in markets where it previously struggled to gain traction.

Challenges Ahead for Entry-Level Brands

Realme rounded out the top five with 3% of total shipments, but the brand faced headwinds as shipments dropped by 21% compared to Q4 2024. This decline reflects broader challenges facing smaller manufacturers competing in Europe's crowded smartphone landscape.

Industry analysts warn that the positive Q4 results may not signal sustained growth for the region. An ongoing memory chip crisis is expected to create turbulence throughout 2026, with projections indicating significant demand contraction ahead. Manufacturers heavily dependent on entry-level and budget segments will likely face the most severe challenges as component costs rise and consumer purchasing power remains constrained.

Source