The Apple. The data reveals 152 million units shipped throughout the year, marking just a 0.5% year-over-year increase from 2024 figures.

Market Share Rankings and Key Players

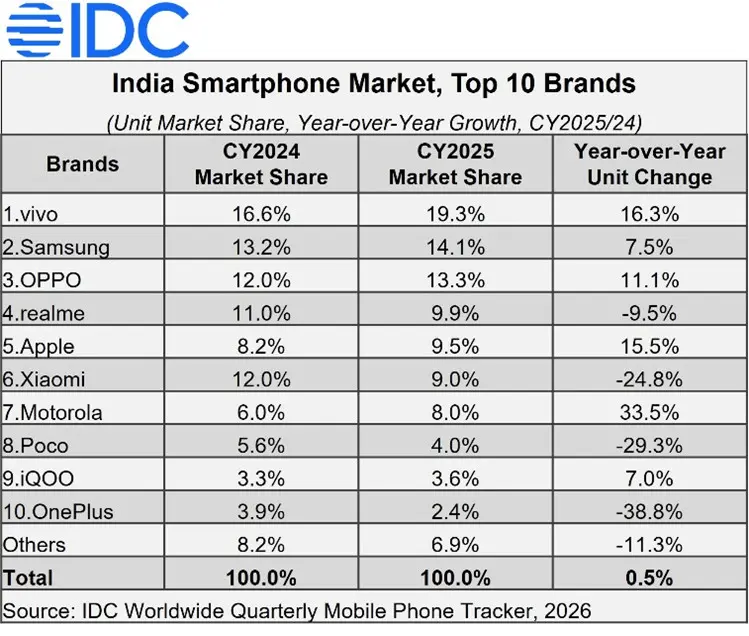

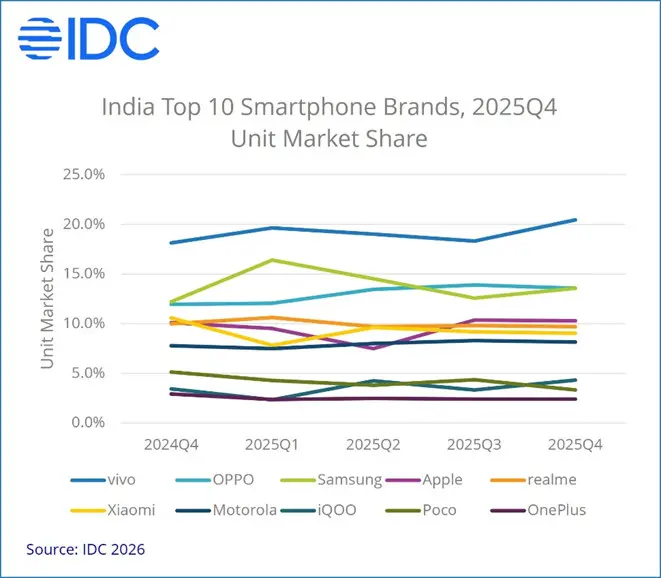

vivo maintained its lead in the Indian market with a 19.3% share, followed by Samsung at 14.1% and Oppo at 13.3%. Realme secured fourth place despite a 9.5% shipment decline. Apple captured fifth position overall with 10% market share, though the company dominated value-based metrics with an impressive 29% share.

Several brands experienced significant challenges in 2025. Xiaomi, OnePlus and Poco faced the steepest declines, dropping 29.3%, 38.8% and 24.8% respectively. However, emerging players like iQOO, Motorola and Nothing showed strong momentum as India's fastest-growing brands this year.

Premium Segment Growth Drives Value

Indian consumers are shifting toward higher-value smartphones. Average selling prices climbed 4% year-over-year to reach $279, while total market value increased 9% compared to 2024. This trend reflects rising wages and changing preferences across the country.

Apple's dominance in premium segments stands out. The company controls 74% of the $600-$800 category, primarily through strong sales of the iPhone 15, iPhone 16 and iPhone 17. These three models alone accounted for over 65% of shipments in this segment. In the $800+ super-premium category, Apple holds 63% share, with Samsung trailing at 34% after an 80% sales increase.

Price Segment Breakdown

Performance varied significantly across price tiers. Entry-level devices under $100 stayed flat, though Xiaomi and vivo together control over 40% of this space. The $100-$200 mass-budget range saw vivo, Oppo and Motorola leading sales.

Growth concentrated in higher price brackets. The $200-$400 entry-premium segment expanded modestly, led by vivo, Samsung and Motorola. The $400-$600 mid-premium category grew 23%, with Samsung and Oppo as top performers. Most impressively, the $600-$800 premium segment surged 37% year-over-year.

2026 Outlook

The bifurcated market tells a clear story. While budget segments stagnate, premium categories show robust expansion. This structural shift indicates Indian consumers are increasingly prioritizing quality and features over pure affordability. Manufacturers adapting to this premium trend, particularly iQOO, Motorola and Nothing, are capturing opportunities that Xiaomi's decline has created.

Source