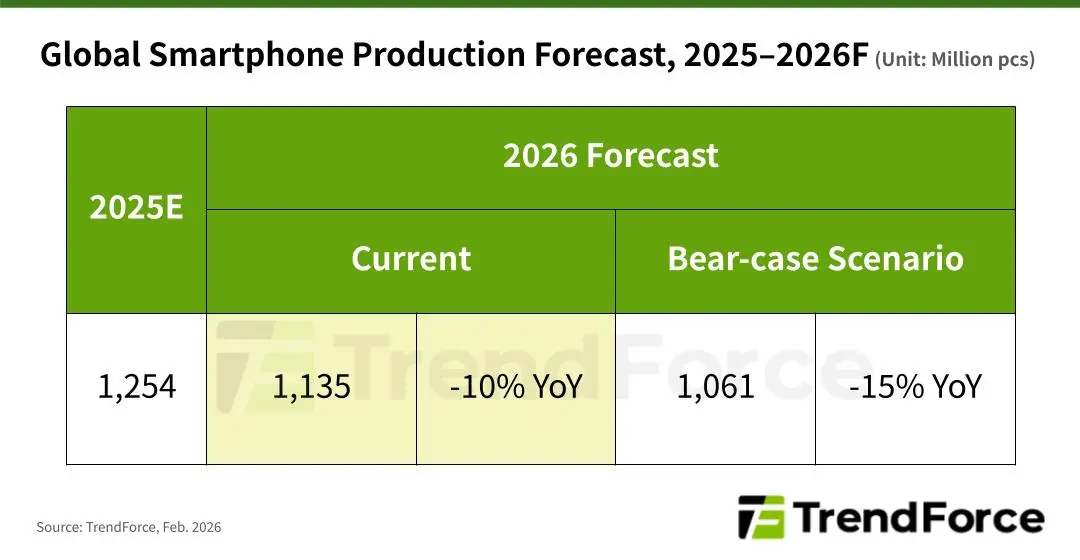

Smartphone manufacturers are bracing for a challenging year ahead. A new forecast from TrendForce reveals that the ongoing memory chip shortage will likely trigger a significant drop in global smartphone shipments throughout 2026. The market research firm predicts a 10% decline, which would bring total shipments down to approximately 1.135 billion units for the calendar year.

The Bear-Case Scenario Looks Even Bleaker

While a 10% drop is already concerning, TrendForce outlines an even darker possibility. Under what the firm calls the "Bear-case scenario," shipment declines could reach as steep as 15%. This would push global smartphone volume to just 1.061 billion units for 2026. The contrast with recent performance makes this projection particularly worrying. Despite various market headwinds, 2025 actually closed with modest growth of 2%, achieving between 1.24 and 1.26 billion unit shipments. That momentum now appears to be reversing.

Why Memory Costs Are Driving Prices Up

The root cause traces directly to component costs. Samsung and other memory suppliers have raised prices substantially, and these increases ripple through the entire supply chain. TrendForce provides a striking example: memory components historically represented just 10-15% of an average smartphone's bill of materials (BOM). Today, that figure has exploded to 30-40%. This dramatic cost spike leaves manufacturers with difficult choices. They can either absorb the losses, pass costs to consumers, or scale back production. Many will likely choose the latter option.

Winners and Losers in This Market Shift

Not every company will feel this pressure equally. Apple maintains significant advantages in this environment. The company's customer base has consistently shown willingness to accept price increases, giving Cupertino flexibility that competitors lack. Additionally, premium device makers generally face less resistance when adjusting retail prices compared to budget-focused brands.

Samsung also holds strategic advantages through its vertical integration. As both a leading smartphone manufacturer and a dominant memory supplier, the Korean tech giant can better manage supply chain disruptions and cost fluctuations. This dual position provides insulation that pure-play handset makers cannot replicate.

Chinese OEMs Face the Toughest Challenges

The situation looks considerably more difficult for Chinese manufacturers. Xiaomi and similar brands target price-conscious consumers, particularly in emerging markets where entry-level and mid-range devices dominate. These segments operate on razor-thin margins, leaving little room to absorb component price hikes.

When memory costs surge by 20-30%, a $150 smartphone becomes economically challenging to produce at previous volumes. Manufacturers must either raise prices and risk losing customers, or reduce shipments and cede market share. Many will opt for conservative production targets, contributing to the overall shipment decline TrendForce anticipates.

What This Means for Consumers

Buyers should expect higher prices across virtually all smartphone categories in 2026. The memory shortage affects everything from budget devices to flagship models, though premium segments can better weather the storm. Consumers holding older devices may find compelling reasons to delay upgrades, potentially extending replacement cycles beyond the current average.

For the industry, this forecast signals a return to supply chain volatility after several years of relative stability. How manufacturers navigate these cost pressures will likely reshape competitive dynamics throughout 2026 and beyond.

Source